Content

You should be ablanalyze and interpret the statement of stockholders’ equity for a business. You should be to understand the business manager’s responsibilities for the financial statements of a business. You should be able to understand how the statement of stockholders’ equity is organized. Stash does not represent in any manner that the circumstances described herein will result in any particular outcome. While the data and analysis Stash uses from third party sources is believed to be reliable, Stash does not guarantee the accuracy of such information. Nothing in this article should be considered as a solicitation or offer, or recommendation, to buy or sell any particular security or investment product or to engage in any investment strategy.

- Let’s look at the expanded accounting equation to clarify what constitutes Owners’ or Shareholders’ Equity before we examine its presentation on the Balance Sheet and Statement of Owners’ Equity.

- Capital structure is the particular combination of debt and equity used by a company to funds its ongoing operations and continue to grow.

- For example if WH3 Corp., issues 10,000 shares of stock, each share will then represent 1/10,000th of the entire amount of ownership stock for the corporation.

- Net income that a company has earned over its history but hasn’t distributed to stockholders in the form of dividends.

- Where the difference between the shares issued and the shares outstanding is equal to the number of treasury shares.

- This format is usually supplemented by additional explanatory notes about changes in other equity accounts.

You should be able to understand accumulated income and other comprehensive income. If you purchase this plan, you will receive Financial Counseling Advice which is impersonal investment advice. To be eligible to receive a Stock Reward through stock party, you must complete the account registration process and open an individual taxable brokerage account (“Personal Portfolio”) that is in good standing. Stash through the “Diversification Analysis” feature does not rebalance portfolios or otherwise manage the Personal Portfolio Account for clients on a discretionary basis. Recommendations through this tool are considered personalized investment advice.

What is stockholders’ equity?

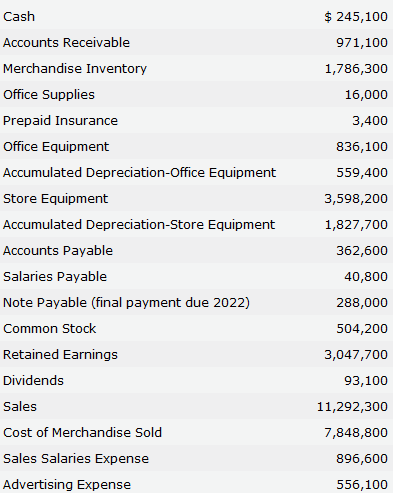

After that, the stock can be traded freely, but the money that is paid directly to the company for that initial offering is the share capital. The following calculation example shows how stockholders’ equity can change from the beginning to the end of an accounting period. The first formula of Stockholder’s Equity can be interpreted as the Number of Assets left after paying off all the Debts or Liabilities of business. Positive Stockholder’s Equity represents the company has sufficient assets to pay off its debt. In the same way, Negative Stockholders Equity represent the weak financial health of the company. Additional Paid-in CapitalAdditional paid-in capital or capital surplus is the company’s excess amount received over and above the par value of shares from the investors during an IPO.

Non-Current Liabilities are the payables or obligations of an entity which might not be settled within twelve months of accounting such transactions. CreditorA creditor refers to a party involving an individual, institution, or the government that extends credit or lends goods, property, services, or money to another party known as a debtor. The credit made through a legal contract guarantees repayment within a specified period as mutually agreed upon by both https://online-accounting.net/ parties. A Stockholder is a person, company, or an institution who owns one or more company shares and whose name share certificate has been issued by the company. They are the company owners, but their liability is limited to the extent of their value of shares. Long-term assets are the value of the capital assets and property such as patents, buildings, equipment and notes receivable. These assets should have been held by the business for at least a year.

Stockholder

A debt issue doesn’t affect the paid-in capital or shareholders’ equity accounts. Stockholders’ equity is the value of a company’s assets that remain after subtracting liabilities and is located on the balance sheet and the statement of stockholders’ equity. A few more terms are important in accounting for share-related transactions. The number of shares authorized is the number of shares that the corporation is allowed to issue according to the company’s articles of incorporation. The number of shares issued refers to the number of shares issued by the corporation and can be owned by either external investors or by the corporation itself. Therefore, debt holders are not very interested in the value of equity beyond the general amount of equity to determine overall solvency.

Investment advisory services are only provided to investors who become Stash Clients pursuant to a written Advisory Agreement. When companies form, they often have to designate a par value for their stock.

Applications in Financial Modeling

There are four key dates in terms of dividend payments, two of which require specific accounting treatments in terms of journal entries. There are various kinds of dividends that companies may compensate its shareholders, of which cash and stock are the most prevalent. To see how this is calculated in practice, here’s an example of what a hypothetical company’s balance sheet might look like, including assets, liabilities, and stockholders’ equity. Your friends help you move into a new apartment, and you promise to buy them pizza in return.

- The original source of stockholders’ equity is paid-in capital raised through common or preferred stock offerings.

- In an initial public offering, a set amount of stock is sold for a set price.

- This is the cumulative amount of income for a few items that are not reported on the corporation’s income statement.

- Shares OutstandingOutstanding shares are the stocks available with the company’s shareholders at a given point of time after excluding the shares that the entity had repurchased.

- Our online training provides access to the premier financial statements training taught by Joe Knight.

- At some point managers need to understand the statements and how you affect the numbers.

For example, if a company buys back 100,000 shares of its common stock for $50 each, it reduces stockholders’ equity by $5,000,000. When a company generates net income, or profits, and holds on to it rather than pay it out as dividends to shareholders, it’s recorded as retained earnings, which increase stockholders’ equity.

Stockholders’ Equity Example

Low or declining stockholders’ equity could indicate a weak business, and/or a dependency on debt financing. However, low or negative stockholders’ equity is not always an indication of financial distress. Newer or conservatively managed companies may have lower expenses, thereby not requiring as much capital to produce free cash flow.

If the stock is publicly traded, investors can sell their ownership interest in a corporation in a matter of minutes simply by giving instructions to their stockbroker or through a computer app. If the stock is not publicly traded, the stock certificate can be transferred to another owner by signing a transfer statement. This is the cumulative amount of income for a few items that are not reported on the corporation’s income statement. Total liabilities are the sum of a company’s current liabilities and long-term liabilities. Understanding stockholders’ equity is one way that investors can learn about the financial health of a firm.

What Does Statement of Stockholders’ Equity Mean?

There is no guarantee that any strategies discussed will be effective. The statement of stockholder equity typically includes four sections that paint a picture of how the business is doing. Unrealized gains and losses.These are the gains and losses a business sees as a direct result of a change in the value of its investments.

Giới thiệu sản phẩm độc đáo

Quà tặng ngày 30/4 và 1/5 ý nghĩa – Giá cả hợp lý – Giao hàng toàn quốc

Quà tặng 30/4 và ngày 1/5 hàng năm không thể thiếu trong các doanh nghiệp....

GỐM SỨ BÁT TRÀNG – MEN MỚI MEN HỎA BIẾN

Bát Tràng là một trong những làng nghề truyền thống về gốm sứ ở Việt...

Ly sứ Bát Tràng

Khi thưởng thức món thức uống ngon ngoài chất lượng thì người dùng còn rất...

Phin cà phê gốm Bát Tràng – Tinh hoa của Đất Việt

Thị trường hiện nay có nhiều loại phin cà phê như: phin nhôm, phin inox,...

Top 5 Bộ Ấm trà Bát Tràng không thể thiếu trong gia đình người Việt

“Miếng trầu là đầu câu chuyện”. Người Việt với truyền thống hiếu khách bao đời...

Bộ bàn ăn gốm Bát Tràng-Sự lựa chọn hoàn hảo cho món quà tân gia

Nếu bạn muốn thể hiện gu thẩm mỹ tinh tế và gây ấn tượng với...